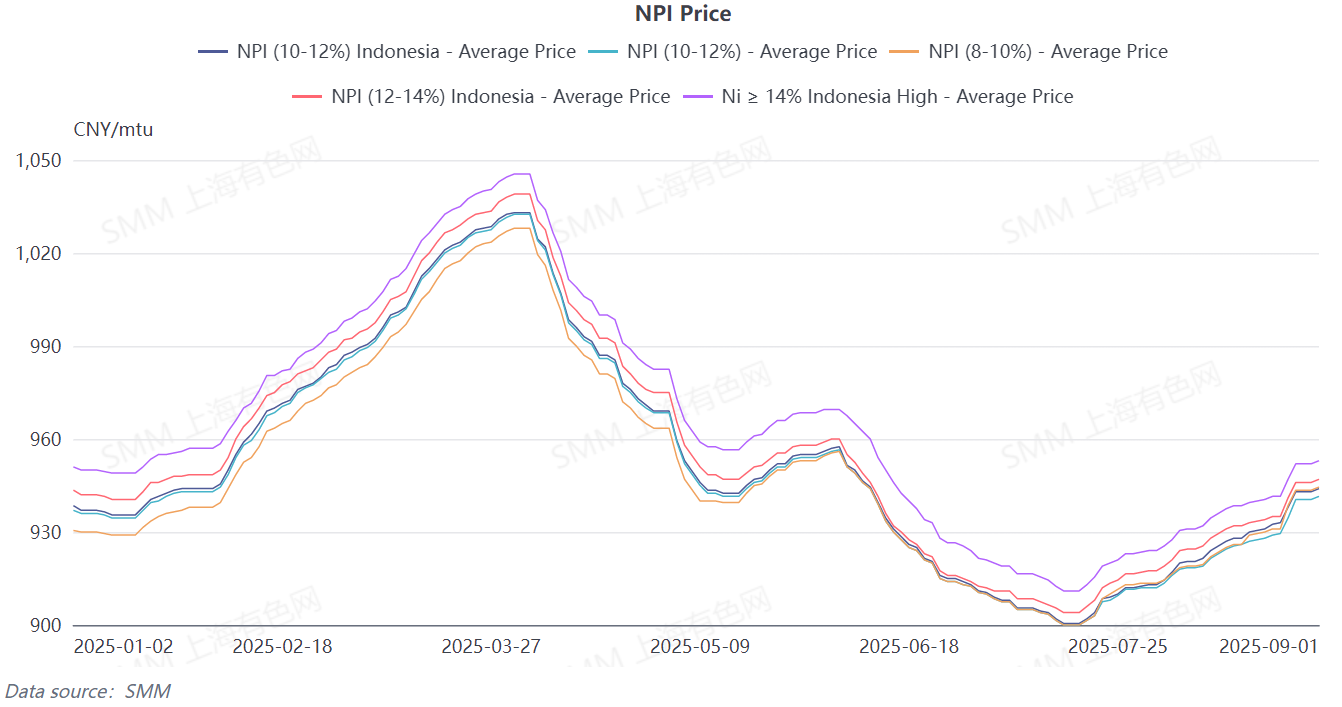

The SMM average price of 10-12% high-grade NPI rose WoW by 6.5 yuan/mtu to 943.6 yuan/mtu (ex-factory, tax included), while the Indonesian NPI FOB index price increased WoW by 0.88 $/mtu to 115.72 $/mtu. This week's analysis of the high-grade NPI market is as follows:

Supply and demand side, as the traditional peak season approaches and expectations for US Fed interest rate cuts drive futures higher, high-grade NPI prices have also risen. Supply side, smelters remain in cost inversion, with firm cost lines supporting high-grade NPI prices. Upstream enterprises anticipate higher prices during peak season, leading to gradual increases in market offers and transaction prices. Demand side, downstream consumption is slowly improving, with stainless steel finished product inventories continuing destocking. The consumption recovery has boosted market confidence. Overall, supported by the traditional peak season, high-grade NPI prices continue to rise. However, it is worth noting that some downstream sectors still show limited acceptance of high prices, while some low-priced inventories from earlier periods remain in the market. High-grade NPI prices are expected to maintain a slow upward trend next week.

From the perspective of expectations for high-grade NPI conversion, nickel prices rose significantly this week driven by macro factors, while high-grade NPI prices increased slowly. The average discount of high-grade NPI to refined nickel widened to 278.1 yuan/mt this week. Refined nickel prices are expected to continue rising next week amid expectations for US Fed interest rate cuts, with high-grade NPI prices maintaining a slow growth trend. The average discount of high-grade NPI to refined nickel may further widen, creating incentives for the conversion of high-grade NPI to high-grade nickel matte. Meanwhile, externally purchased high-grade nickel matte for nickel sulphate production demonstrates greater profitability advantages. The proportion of NPI converted to high-grade nickel matte is projected to have upward potential.

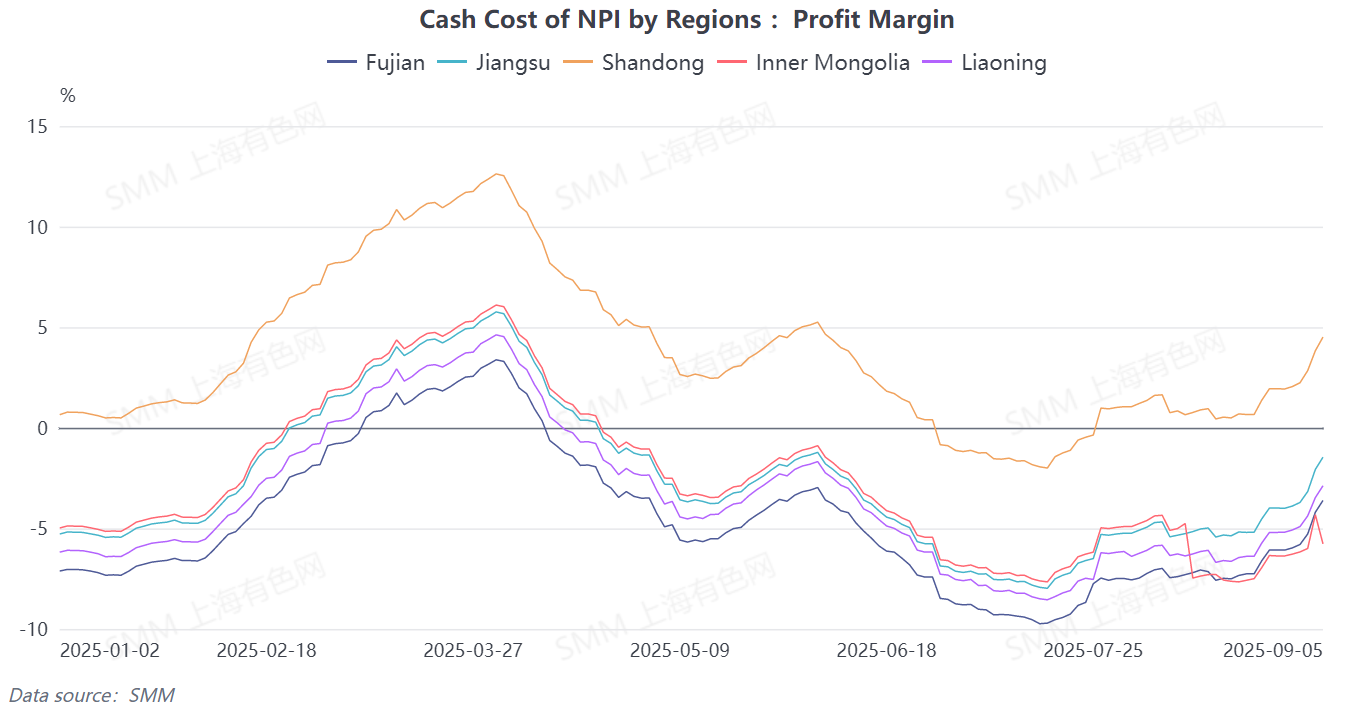

From the perspective of high-grade NPI profitability, based on nickel ore prices calculated 25 days ago, most smelters' cash costs for high-grade NPI remained inverted this week. Raw material side, core costs such as nickel ore from the Philippines and Indonesia held steady, keeping smelter cost lines firm. However, due to the MoM rise in NPI grade, high-grade NPI costs saw some adjustments. Next week, auxiliary material prices are expected to remain stable, while Indonesian nickel ore prices may drop slightly. With anticipated rises in high-grade NPI prices, smelter profit margins are projected to improve moderately.

Overall, as the peak season approaches, high-grade NPI prices show a gradual upward trend. However, due to the presence of previously low-priced inventory in the market and relatively slow growth in stainless steel consumption and prices, transaction prices for high-grade NPI are expected to have limited upside in the short term. High-grade NPI prices are forecast to range between 940-960 yuan/mtu next week, up 10-12%.